Table of Contents

- How to make a tax payment online to the IRS - YouTube

- How to pay the IRS online. Pay income taxes. Pay the IRS taxes online ...

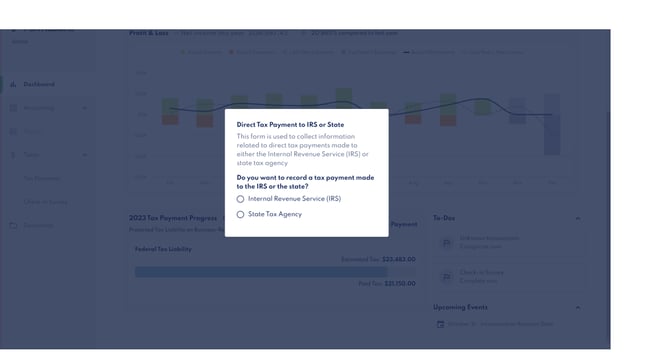

- How to report direct tax payment to the IRS or State?

- How to report direct tax payment to the IRS or State?

- IRS Clarifies Federal Tax Impact of Special State Payments | Dykema

- Irs Tax Relief 2024 Payment - Marni Sharron

- How To Pay Your Tax Bill In 2019

- A Step-by-Step Guide to IRS Payment Plans | Gusto

- What happens if I owe the IRS and can’t pay? Leia aqui: What happens if ...

- IRS Direct Pay one of many ways to pay estimated taxes - Don't Mess ...

According to the IRS, taxpayers can choose from a range of payment methods, including online, phone, and mail options. The IRS also offers payment plans for those who cannot pay their taxes in full. In this guide, we'll break down each payment method, including the benefits and any associated fees.

1. Electronic Federal Tax Payment System (EFTPS)

The Electronic Federal Tax Payment System (EFTPS) is a free online payment system that allows taxpayers to pay their taxes online or by phone. To use EFTPS, taxpayers need to create an account on the IRS website and schedule a payment. This method is convenient, secure, and free.

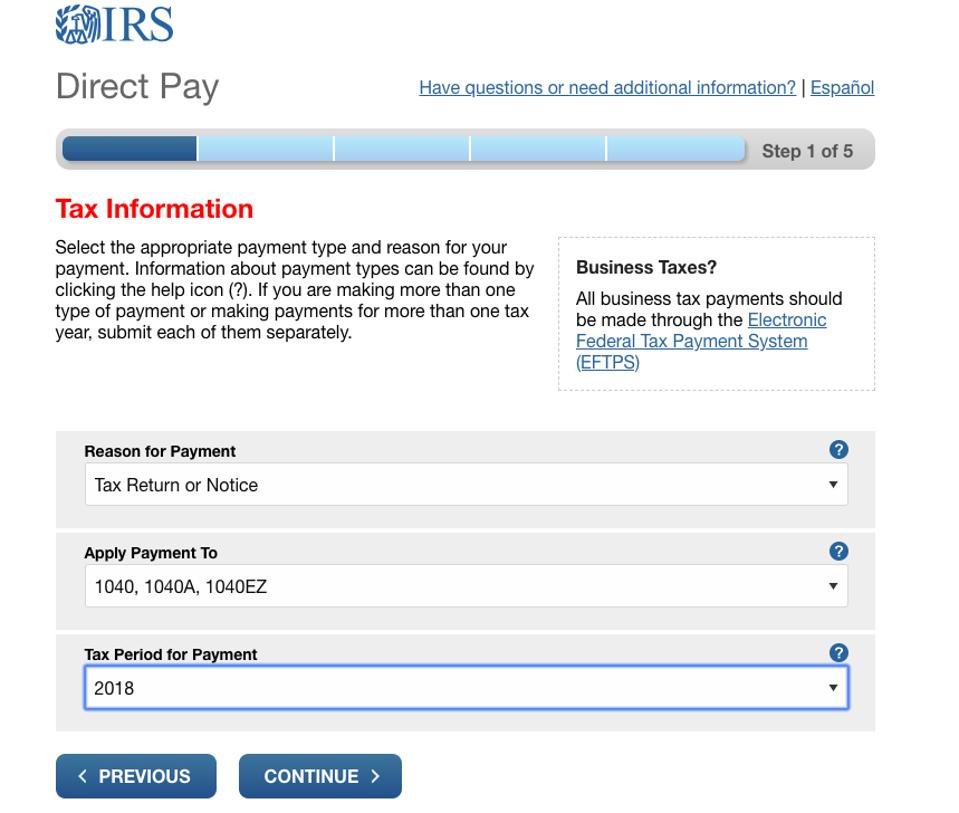

2. IRS Direct Pay

IRS Direct Pay is another online payment option that allows taxpayers to pay their taxes directly from their checking or savings account. This method is also free and can be used to pay individual or business taxes.

3. Credit or Debit Card

Taxpayers can also pay their taxes using a credit or debit card. The IRS accepts payments from major credit card companies, including American Express, Discover, Mastercard, and Visa. However, a processing fee applies to credit card payments.

4. Check or Money Order

For those who prefer to pay by mail, the IRS accepts checks and money orders. Taxpayers should make the check or money order payable to the United States Treasury and include their name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

5. Cash

The IRS also accepts cash payments at participating retail partners, such as 7-Eleven, Ace Cash Express, and Dollar General. Taxpayers can use the IRS2Go app to find a nearby payment location.

6. Online Banking

Many banks and financial institutions offer online bill pay services that allow taxpayers to pay their taxes online. This method is convenient and often free.

7. Phone

Taxpayers can also pay their taxes by phone using the IRS's automated phone system. To make a payment, call the IRS at 1-800-829-1040 and follow the prompts.8. IRS Mobile App

The IRS2Go app allows taxpayers to make payments on their mobile device. The app is available for both iOS and Android devices.

9. Payment Plan

For taxpayers who cannot pay their taxes in full, the IRS offers payment plans. Taxpayers can apply for a payment plan online or by phone and make monthly payments until the tax bill is paid in full.In conclusion, the IRS offers a range of payment options to make it easy for taxpayers to pay their taxes. Whether you prefer to pay online, by phone, or by mail, there's a payment method that suits your needs. By following these 9 ways to pay your taxes, you can avoid penalties and interest and stay on top of your tax obligations.

Remember to always keep a record of your payment, including the payment date, amount, and method. If you're unsure about which payment method to use or have questions about your tax bill, contact the IRS or consult a tax professional for guidance.