Table of Contents

- What Is the Meaning of Dead Cat Bounce in Investing?

- Dead Cat Bounce dalam Analisis Teknikal Pasaran - Teknik Trade ...

- Dead Cat Bounce Strategy for Forex Traders - InvestGrail

- Dead Cat Bounce : r/editorialcartoons

- How to Spot a 'Dead Cat Bounce' (+ Strategies to Trade It) - DTTW™

- How to Trade the Dead Cat Bounce | TradingSim

- What is a Dead Cat Bounce? Definition, Explanation, and Trading Guide

- DEAD CAT BOUNCE PATTERN. - PURCOW Exchange - Medium

- Dead Cat Bounce in Forex: Here’s What You Need to Know

- What is a Crypto Dead Cat Bounce?

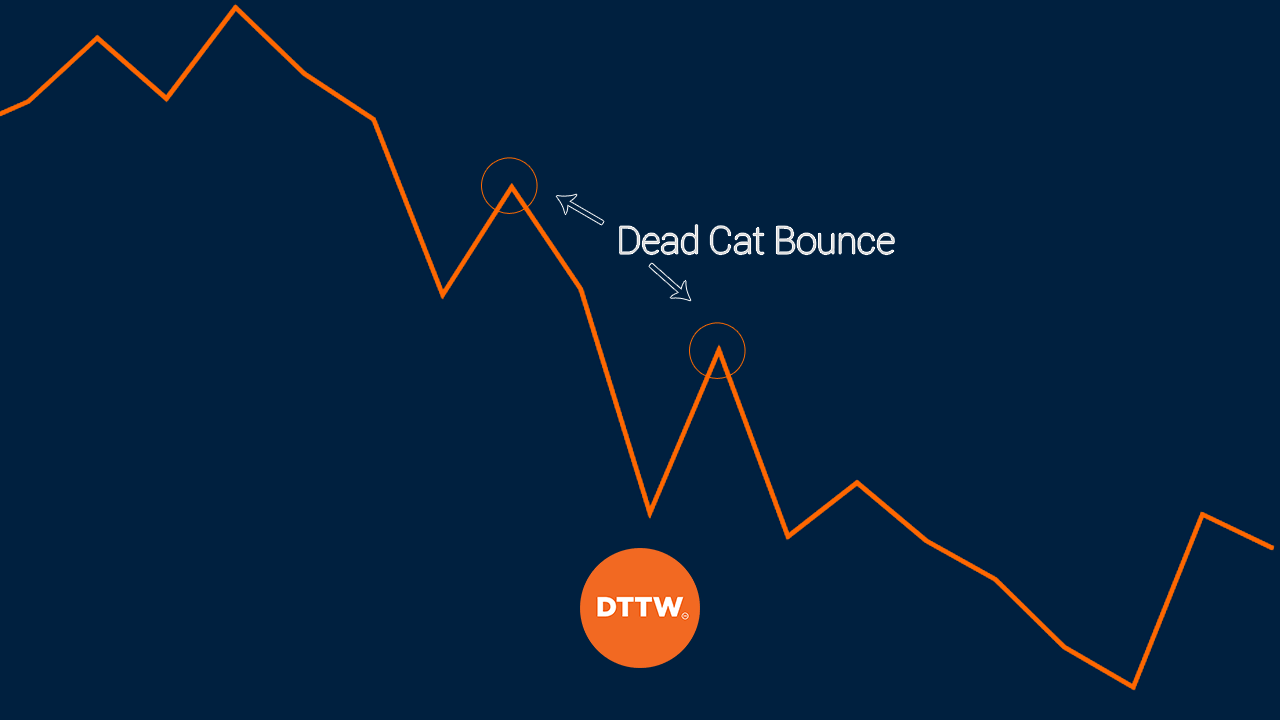

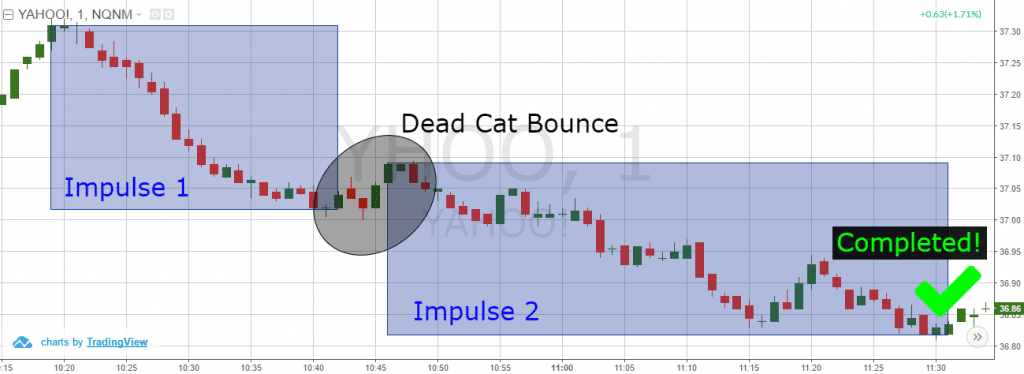

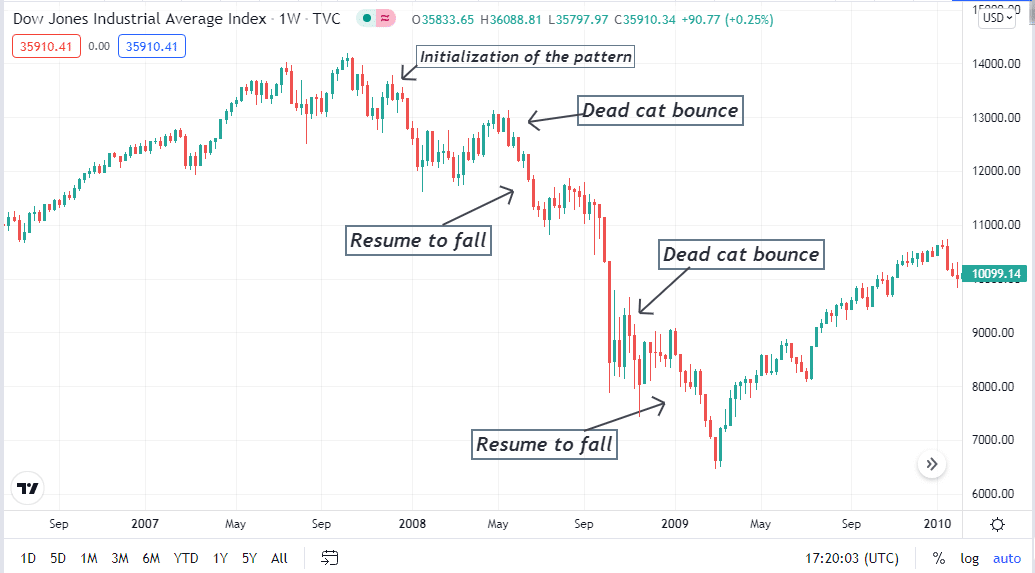

What is a Dead Cat Bounce?

How to Spot a Dead Cat Bounce

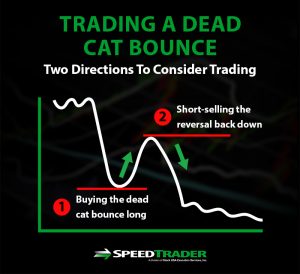

Impact on Investment Strategy

So, how can you protect your investments from the dead cat bounce? Here are some tips: Stay informed: Keep up-to-date with market news and analysis to understand the underlying reasons for the rebound. Don't chase the bounce: Avoid buying into a stock or asset solely because of a dead cat bounce. Focus on fundamentals: Look for companies or assets with strong fundamentals, such as solid financials, competitive advantage, and growth prospects. Diversify your portfolio: Spread your investments across different asset classes to minimize risk. In conclusion, the dead cat bounce can be a misleading phenomenon that can lead to poor investment decisions. By understanding what it is, how to spot it, and how to adjust your investment strategy, you can navigate the markets with more confidence. Remember to stay informed, focus on fundamentals, and diversify your portfolio to minimize risk.Source: SoFi

Note: The article is written in a way that is easy to understand, and the html format is used to make it SEO-friendly. The title is new and descriptive, and the headings are used to break up the content and make it easier to read. The article is approximately 500 words long.