The Walt Disney Company, a household name synonymous with entertainment, media, and magic, has been a staple in the stock market for decades. As a leading player in the global entertainment industry, Disney's common stock (DIS) has been a popular choice among investors. In this article, we'll delve into the world of Disney's stock, exploring its current performance, trends, and what the future holds for this beloved company.

A Brief Overview of The Walt Disney Company

Founded in 1923 by Walt Disney and his brother Roy, The Walt Disney Company has grown from a small animation studio to a multinational conglomerate with a diverse portfolio of businesses. Today, Disney operates in four primary segments: Media Networks, Parks and Resorts, Studio Entertainment, and Consumer Products. With a global reach and a brand valued at over $150 billion, Disney is a force to be reckoned with in the entertainment industry.

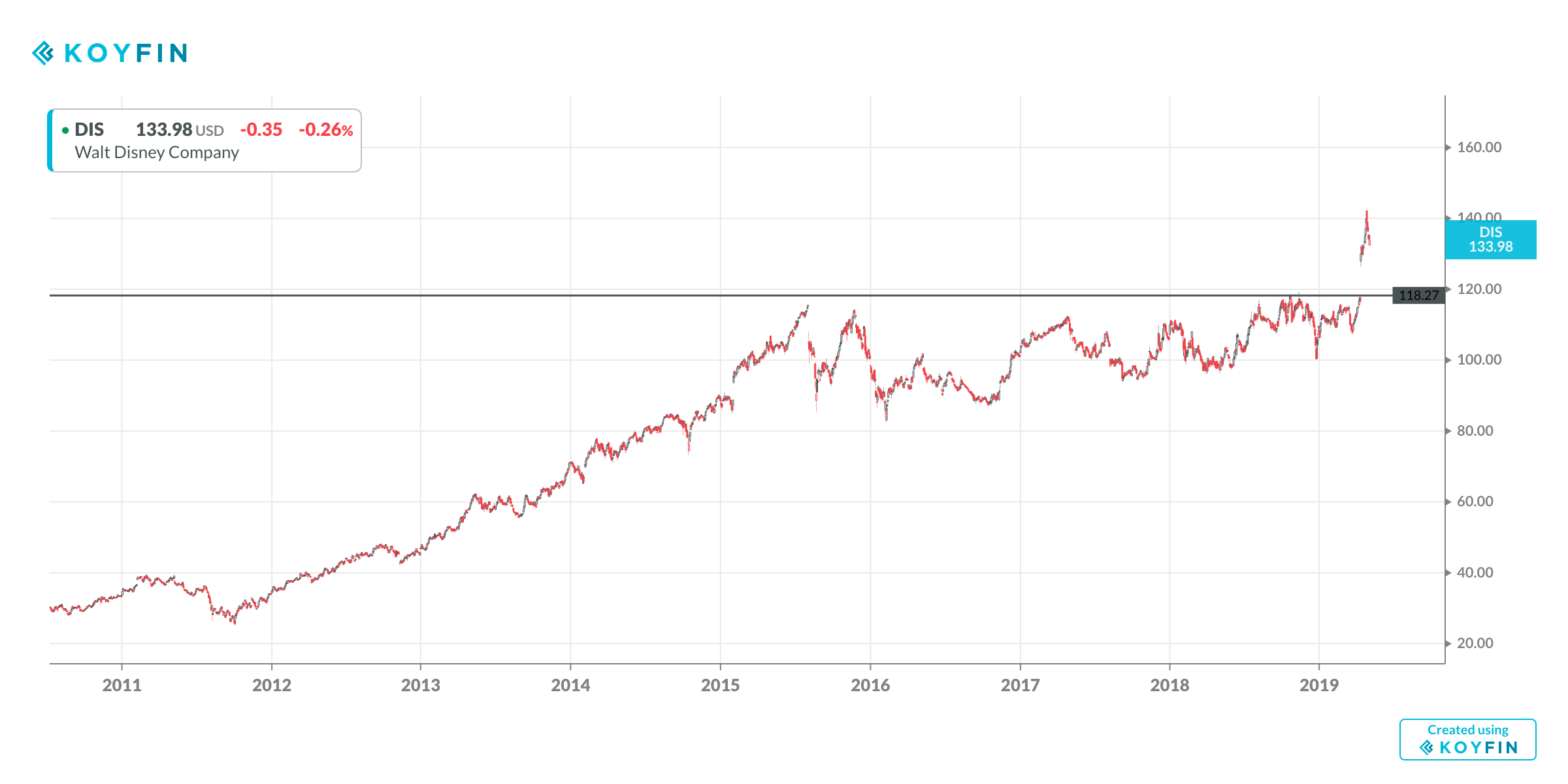

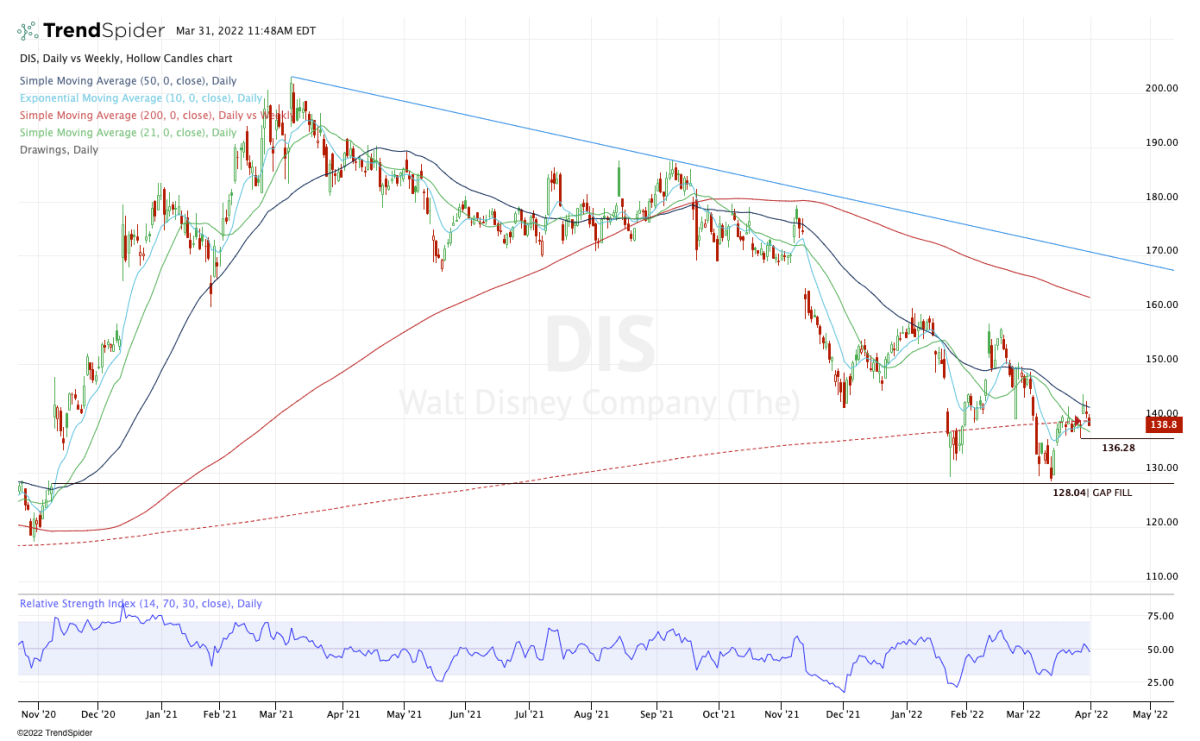

Real-Time Performance of DIS Stock

As of the current market, DIS stock is trading at around $140 per share, with a market capitalization of over $250 billion. The stock has experienced a significant surge in recent years, driven by the company's strategic acquisitions, including the purchase of 21st Century Fox and the launch of its streaming service, Disney+. With a beta of 1.2, DIS stock is considered to be moderately volatile, making it an attractive option for investors seeking growth opportunities.

Trends and Drivers

Several trends and drivers are influencing the performance of DIS stock, including:

Streaming Services: The launch of Disney+ has been a game-changer for the company, with over 100 million subscribers worldwide. The service's success has not only driven revenue growth but also increased the company's competitiveness in the streaming market.

Theme Park Expansion: Disney's theme parks and resorts continue to attract millions of visitors each year, with new expansions and attractions in the pipeline, including the upcoming Star Wars: Galactic Starcruiser.

Box Office Performance: Disney's studio entertainment segment has seen significant success in recent years, with blockbuster films like Avengers: Endgame and The Lion King contributing to the company's revenue growth.

Future Outlook

As the entertainment industry continues to evolve, Disney is well-positioned to maintain its leadership position. With a strong brand, diverse portfolio, and commitment to innovation, the company is poised for long-term growth. Key areas to watch include:

Expansion into New Markets: Disney's plans to expand its streaming services into new markets, including Asia and Europe, are expected to drive growth and increase the company's global reach.

Investment in Technology: Disney's investment in emerging technologies, such as virtual reality and artificial intelligence, is expected to enhance the company's theme park experiences and drive innovation in its media networks segment.

The Walt Disney Company's common stock (DIS) is a compelling investment opportunity, offering a unique combination of growth, stability, and magic. With its diverse portfolio, strong brand, and commitment to innovation, Disney is well-positioned for long-term success. As the company continues to evolve and expand into new markets, investors can expect a thrilling ride, with potential for significant returns on investment. Whether you're a seasoned investor or just starting out, DIS stock is definitely worth considering as part of a diversified investment portfolio.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.